Section 321 Fulfillment: Save Up to 20% in Duty & Tariff Costs

NLS and Section 321:

Optimize Your Direct-to-Consumer

eCommerce Business

Section 321 is a valuable exemption in the Canada-U.S.-Mexico Agreement that allows small shipments to enter the U.S. duty-free. For direct-to-consumer (DTC) eCommerce retailers, leveraging this exemption presents an excellent opportunity to reduce your cost per unit by waiving or refunding import duties on items shipped from Canada to U.S. recipients, all while ensuring a seamless customer experience.

How Does Section 321 Work?

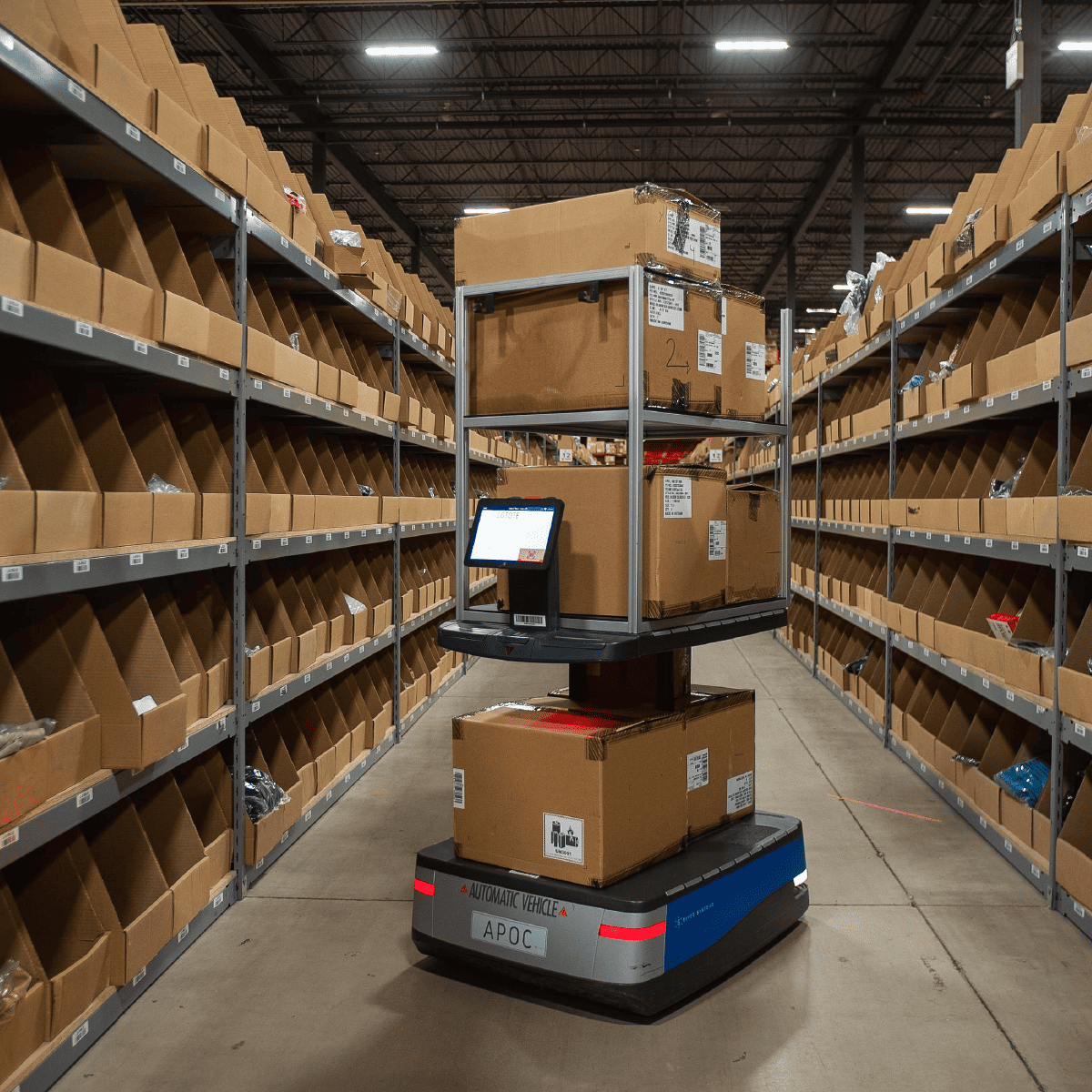

Section 321 begins when goods are shipped to one of NLS’s secure facilities in Canada.

Our in-house duty and tariff experts handle the paperwork to ensure your merchandise is swiftly cleared through customs if necessary.

Your goods are then added to our warehouse inventory. Then when a customer places an order, our dedicated team picks, packs, and ships the items.

NLS prepares all necessary documents for U.S. Customs, and your items are shipped across the border and delivered using our extensive network of trusted U.S. carriers.

Finally, any duties and tariffs paid in Canada are promptly refunded to you, further reducing your overall costs.

US Section 321

NLS Experts Can Help With Section 321

If you’re familiar with the basics of Section 321 already but are uncertain about where to begin or how you can take advantage of the benefits for your Direct-to-Consumer brand.

Our team of experts at NLS are here to help.

We offer comprehensive knowledge on:

The Competitive Advantages of Using Section 321

The Section 321 Process Workflow

Getting Set Up for Section 321 Shipping

Important Rules and Regulations Pertaining to Section 321

Our team of supply chain consultants works closely with your brand to understand the benefits of duty drawback and duty elimination, guiding you through the Section 321 process.

We provide strategic planning and consultation to help your business significantly reduce or even eliminate import duty tariff costs while ensuring compliance with non-resident trade regulations.

Key Benefits of Section 321 Shipping with NLS

- A smooth and efficient delivery experience as if it were fulfilled domestically.

- Extensive knowledge of the U.S. and Canadian supply chain industry.

- Established relationships with top U.S. carriers.

- Help with developing a streamlined cross-border strategy tailored to your specific needs.

- Save up to 20% on Duties and Tariffs.

- Significantly reduce your shipping costs, positively impacting your bottom line.

- Seamless Coast-to-Coast responsiveness.

- Cater to customers from coast to coast with our multiple facilities across Canada.

Is Section 321 Shipping Right For You?

Our team supports you with strategic planning and consultation to help your brand set up US eCommerce fulfilment directly from Canada. This will enable you to leverage Section 321, which can reduce or eliminate your import duty and tariff costs.

With Section 321, you’ll ship products from our Canadian facilities to your consumers in the U.S., but the delivery experience will be no different than if it was fulfilled domestically.

In order to ship under Section 321, individual orders must be valued at less than $800 USD and weigh less than 50 lbs (22 kg).

With NLS’s U.S. relationships, you’ll be able to work seamlessly with carriers while to reach 80% of US consumers in under 3 days while saving up to 20% on Duties and Tariffs.

SECTION 321:

Frequently Asked Questions

Section 321 can seem complicated and hard to understand. But the entire process is actually completed in four quick and easy steps that save you money while delivering to your customers in an efficent timeframe.

Orders are appropriately labelled for domestic U.S. delivery. All necessary documentation is then meticulously prepared for U.S. Customs, ensuring a hassle-free streamlined process.

Next, parcels are scanned and consolidated for enhanced efficiency. From here your parcels are reviewed by customs. U.S. Customs reviews and releases all eligible parcels without any duty payable, allowing for easy clearance.

Your parcels will next arrive at a U.S. courier facility, ready for delivery. The delivery experience remains consistent with domestic fulfillment, ensuring customers receive their orders reliably and without delays, keeping that seamless customer experience.

With your parcels delivered, any duties paid in Canada are promptly refunded. You have now further maximized your cost savings while upholding your delivery standards.

A Full Suite of Omnichannel Capabilities

Talk To An Expert and Get Started Today

To explore how NLS can empower your business with the exact delivery times and costs as a fulfillment provider, while saving you up to 20% on duty and tariff costs, request a consultation with our experts today and unlock the full potential of your cross-border operations.